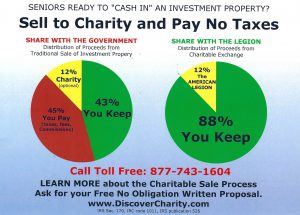

Above is a currently running program hosted by our partner, DiscoverCharity, that is designed to support Post 44’s Legacy Plan.

One of our goals is to restore support of many of the traditional roles of the American Legion. In particular, support for veterans and active-duty soldiers. I have also stated my desire to support a first-class honor guard because they are the face of our organization to the public. Other American Legion core values that we need to find ways to support are Americanism, respect for the flag, as well as children and youth programs.

With the youngest Viet Nam era veterans now turning 60 years old, we are concerned for the long term lifespan of the American Legion and Post 44 in particular. We see a declining membership due to age as well as decreasing numbers of people who serve in the military over the next twenty years, and with that decline, more financial instability for the Post.

We are asking all of our members, Sons and the Auxiliary to help us create an Endowment fund to help keep Post 44 functioning into the foreseeable future.

We have enlisted the aid of two large charitable foundations to assist us in this endeavor. We have an affiliation with the Arizona Community Foundation to create and administer the Endowment Fund for Post 44. Due to our membership requirements, we qualify as a 501-c-3, but we do not have the staff to directly offer planned giving programs. In order to be able to offer these beneficial products to our members, their families and their friends, we have created a working relationship with The Waterstone Christian Foundation and their marketing arm, Discover Charity.

We are seeking gifts of highly appreciated assets such as Real Estate, stocks and art works that would be subject to very high capital gains taxes if sold on the open market. If these assets are sold to Post 44, all taxes and sales costs are waived. Donors can receive an annuity to last for up to two lifetimes based on the market value of the asset. The donor also receives a tax deduction to be applied to any other income.

All transactions will be completed between the member/donor and the Foundation. No Legion member will be involved in the transaction. The Post 44 Endowment Fund will be the named beneficiary of the intended gift.

The real estate assets to be sold/donated can be located anywhere in the United States. The owner/donor does not have to be a legionnaire, so please think of your family and friends back home who may be able to use a tax deduction or who just don’t want to give a large part of their property value to the government.

With an endowment fund, we can be assured that the important programs can continue forever and that Post 44 will continue to be seen as a significant member of the Scottsdale community.

Click here to be connected to our partner organizations to explore the program to see if the proposal is of interest and beneficial to you.

—————————————————–

In addition to these gifting opportunities, traditional gifts can be made through Wills and Living Trusts.

Wills and Living Trusts

By including American Legion Post 44 in your will or living trust, you can make an important and lasting gift for future Legionnaires and Veterans while meeting your financial and estate planning goals. A bequest can take many forms, and because a bequest qualifies for the estate tax charitable deduction, it may reduce your taxable estate.

Common types of bequests:

General: “I give to the American Legion Post 44, a 501(c)(19) headquartered at 7145 East Second Street, Scottsdale, AZ 85251 the sum of __________ dollars (or specific piece of property) to be used as the Leadership directs.”

Bequest of a percentage: “I give and bequeath __________ percent (name specific percentage) of my estate to the American Legion Post 44 , headquartered at 7145 East Second Street, Scottsdale, AZ 85251.”

Bequest of residue: This is a provision in a will leaving the remainder of one’s estate to an organization after all other bequests are fulfilled. “The rest, residue and remainder of my estate, both real and personal, whatever situation, I give and bequeath to the American Legion Post 44 , headquartered at 7145 East Second Street, Scottsdale, AZ 85251.”

Contingent bequest: This leaves a bequest to American Legion Post 44 if any of the other beneficiaries are unable to receive their bequests because of death or other circumstances. Generally this reads:

“Should (name of person) predecease me, the portion of my estate going to (this person) I give and bequeath to the American Legion Post 44 , headquartered at 7145 East Second Street, Scottsdale, AZ 85251.”

To leave a gift from a Living Trust, write:

“I direct my trustee to distribute from the principal of my trust estate to the American Legion Post 44 , headquartered at 7145 East Second Street, Scottsdale, AZ 85251.” : the sum of _________ dollars (or, if stock, land or other property, please describe). “

Retirement Plan Assets

Your IRA, 40 l (k), 403(b) or other qualified retirement plan may be heavily taxed if left to anyone other than a legally recognized spouse. By naming the American Legion Post 44 as a beneficiary of all or a portion of a retirement plan, you avoid both the estate tax and income tax due on these tax-deferred plans if you distributed to your heirs.

Insurance

If you have a life insurance policy you no longer need, you may consider transferring ownership to the American Legion Post 44. You may also purchase a new policy and later name the American Legion Post 44 as the owner and beneficiary. Either gift generates a charitable income tax deduction. The payment of premiums on behalf of the American Legion Post 44 will also enable you to claim income tax charitable deductions.